This article is relevant if you need to perform trust accounting in NetSuite or if you need to move customer deposit funds from one customer to another.

Background

Our firm recently led a major NetSuite implementation for a cemetery. The cemetery organization has two primary offerings:

- Spaces: organized as inventory, space is sold for holding deceased remains.

- Mortuary Services: interment and funeral services for the dead and their families.

For the purposes of this article, we will not review Spaces because most of the NetSuite mechanics in general inventory management are well-understood in the community. However, the mechanics behind mortuary services are interesting due to the idea that families can plan for the purchase of future funeral services in advance of need. The cemetery industry has organized to offer debenture instruments in the form of interest-bearing securities to help fund future mortuary services. Each organization can set up their own terms for offering and serving debenture notes subject to legal restrictions. For this article, I will call the handling of these instruments as NetSuite Trust Accounting.

NetSuite Trust Accounting

NetSuite natively does not offer trust accounting. Yet, the power of the platform allows us to extend existing built-in capacities to solve for this interesting subject matter.

Trusts Relationship to Mortuary Services

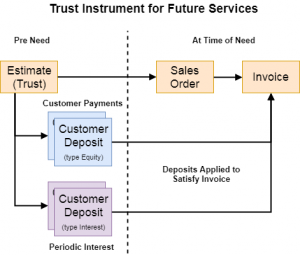

Many families seek to pay their respects to lost loved ones and are willing to plan in advance of need. In our client’s model, families work with counselors to discuss future services for the inevitable difficult day ahead. In NetSuite terms, the Estimate record represents a transaction that can hold the detail for all anticipated services. Thus, we start with the Estimate and we use NetSuite’s convenient record renaming feature to call it a Trust as we are going to connect it to the debenture concept.

Lines on the Trust record represent the desired future services. These services may not actually be needed for years into the future. With today’s debt-based monetary system, we can anticipate the erosion of paper currency purchasing power and thus the price of estimated services today will be higher tomorrow when it is needed. When the actual difficult day arrives, the Trust (estimate) can be converted to a Sales Order and repriced for the fulfillment of mortuary services.

However, by developing the estimate record today, one can anticipate how much will be needed for future services. For example, assume that a counselor plans a future mortuary service and the total estimated amount comes to $5,723.50. The counselor may suggest that a Trust instrument be offered at a Par value of $6,000. The idea is that an installment payment plan can be set up to collect funds to ultimately purchase an interest-bearing note once the Par value is received in full. For example, a 5-year monthly payment of $100 will result in $6,000 collected.

Trust Funds Management

As described above, payment plans are used to collect funds in advance of need. Since the Estimate record will transform into a Sales Order, services will be delivered and invoiced, and the all the funds previously collected can be used to satisfy the invoice. The most natural record to satisfy the payment of an invoice for monies collected in advance is a NetSuite Customer Deposit.

As a side note, many regular readers will recognize that I write much about the customer deposit record. It’s a powerful record for recognizing liabilities before goods and services are delivered and in my assessment, underutilized in the NetSuite community. Please see my related customer deposit articles:

- Create NetSuite Customer Deposits from Opportunities or Estimates

- Applying NetSuite Sales Order Customer Deposits on Independent Invoices

- Using NetSuite Payment Methods to Drive Customer Deposits

- Solved: NetSuite Customer Deposits and Advance Payment Accounting

- Learn the NetSuite SuiteScript 2.0 Pattern to Apply Customer Deposits to Invoices

- Yes You Can: Generate a NetSuite Customer Statement on an Invoice with Customer Deposit Accounting

- Use NetSuite SuiteScript to Automate Posting Customer Deposits to Invoices

To make this solution work, we need to create cross-references between records that are not natively connected. Here, we take Estimate record and use a custom field to cross-reference to a Customer Deposit sublist. This then allows us to see all the funds that have been collected over time. Natively, the customer deposit record wants to connect to a Sales Order. But we don’t have a sales order at this time. Thus a bit of script can emulate NetSuite’s built-in feature to automatically pay an invoice with customer deposit funds when it can see that the customer deposit and invoice are both connected to the same sales order.

Considerations for Interest Payments

These debenture instruments will accrue interest according to the terms offered. We produced an application that will both accrue interest on a daily basis while we recognize and record interest against Trust (estimate) records once they are in the proper state. The interesting feature here is that we actually record interest using, yet again, a Customer Deposit record. Using some SuiteGL with our GL Reclasser tools, we produce this accounting:

Record interest using Customer Deposit record with proper flagging

Dr: Trust Clearing (Zero Balance Account)

Cr: Customer Deposit Liability

Activate SuiteGL to record actual interest through Trust Clearing

Dr: Trust Interest Expense

Cr: Trust Clearing (Zero Balance Account)

Now we can distinguish customer deposit records between customer paid-in capital or interest paid of which both types can be used to satisfy future mortuary service invoices.

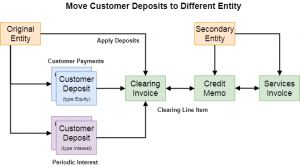

Move Customer Deposit Funds to Another Customer

With all the previous background, we can discuss the mechanics to move customer deposit funds to another customer. Natively, NetSuite will only allow you to pay for an invoice with customer deposit funds if the customer record is part of the customer hierarchy. The reality of the mortuary business is that one family member may have provided the funds but another family member may be needing to use the funds. How then do we handle the situation where the funds must move to another customer?

Move Trust Funds Utility

To accommodate this challenge, we developed a move trust funds utility. The general way to migrate funds from one entity to another follows this pattern:

- Clearing Item: define an item that will have a GL routing that normally will be zero. I recommend a liability account.

- NetSuite Invoice Debit Memo: Create a standalone (floating) invoice against the original entity related to the customer deposit(s) and use the clearing item. Apply the customer deposits trust funds to pay for the standalone invoice.

- NetSuite Credit Memo for Trust Funds: Using the same value amount, create a standalone (floating) credit memo to the target (but related) entity and reference the same clearing item. This credit memo then can be used to pay for future services from the sales order and respective invoice.

In essence, we transformed a customer deposit liability to an accounts receivable credit balance which should get consumed by the services invoice debit balance.

Expand your Capacities with the NetSuite Platform

I believe the discussion above illustrates the power of the NetSuite platform. With a firm understanding of accounting and the capacities to invent, we can make NetSuite do things that are not natively offered. If you have a trust accounting concern and want more out of your NetSuite investment, let’s have a conversation.