This article is relevant if you are using netSuite to accept funds in a different currency to satisfy an invoice accounts receivable.

Background

We led an implementation to design specialized accounting flows for a US based client that conducts global business operations. While their customers are US based, they conduct business with many different foreign partner entities on behalf of their American customers. The client was challenged to account for many foreign currency based transactions.

As we modeled their business inside NetSuite, we helped our client see that just because their customers pay with US dollars, we do not have to denominate the transaction in USD. By conducting the supporting transactions in foreign currency (e.g, related purchase orders, vendor bills, disbursements), the process of fulfillments and other related obligations became more streamlined.

By denominating in foreign currency, we were able to generate customer invoices leveraging NetSuite’s natural ability to always calculate the value in base currency (in this case, USD). For example, the invoice may be denominated in Euro, but during presentation, we would offer it in USD. Hence, invoices would be sent to customers via PDF using our Content Renderer Engine technology and the customer would see USD requested; just as the customer expected. Thus the customer had no idea the transaction was denominated in a foreign currency.

However, when the customer paid the invoice with USD, it produced a cash receipt challenge.

How to Streamline Accepting One Currency for an Invoice Denominated in Another Currency

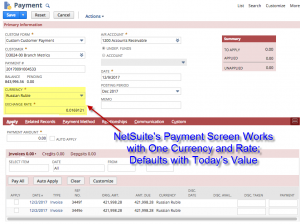

Netsuite’s Accept Payments (cash receipts) system wants to line up the currency that is being received with the invoices / credit memos in the same currency. But we want to receive a different currency than the one the transaction is denominated. In my article, How To: Multiple Foreign Currency Cash Receipt Settlement, I discuss the basic approach around this limitation which leverages the fact that NetSuite uses two steps to accept payments: 1) cash receipt (or payment) and 2) bank deposit. Using two steps, it allows us to cross the currency boundary.

In our client’s situation, they wanted the amount of USD (base currency) accepted to fully satisfy the foreign currency invoice. Generally NetSuite will calculate realized gains and losses when you denominate transactions with a rate on one date, and then some time in the future, satisfy that obligation with the same currency units but with a different exchange rate. However, there really were no realized gains or losses in this situation because the client was indeed willing to accept USD priced at the time the foreign currency invoice was created.

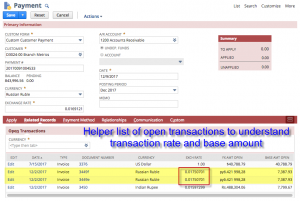

Leverage NetSuite Sublist Technology to See Transactional Information

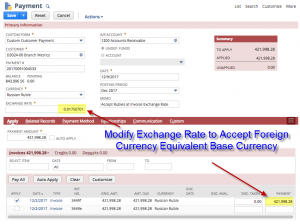

The key to making this work is to modify the exchange rate (which is automatically offered by NetSuite based on the receipt date) to the underlying transaction exchange rate. To get that exchange rate information handy, we crafted a saved search to find all open transactions, list the exchange rates and the equivalent base (USD) currency amounts. See related image.

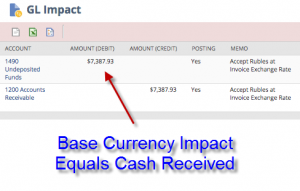

With this information in hand, you can modify the exchange rate and accept the foreign currency units to deem the invoice paid. Here, (see related image) we are not directing the funds to the bank account because we want to use the bank deposit feature in the following step. Instead, we are using NetSuite’s built-in Undeposited Funds feature. Alternatively, we could have created a bank clearing account instead of the Undeposited Funds to give us similar functionality.

Create Bank Deposit To Receive Actual Funds

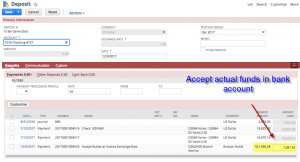

Once the payment is accepted, we can now use NetSuite’s bank deposit feature to receive the actual currency. See example image. Here, we are receiving USD to satisfy a payment denominated in Russian Rubles.

Scaling the NetSuite Foreign Currency Cash Receipt Operation

The above solution is good if you have a few transactions. But admittedly, if you have a significant cash receipt operation in foreign currency, this process is going to be slow. Accordingly, it would be straightforward to build a NetSuite SuiteLet application to indicate the amount of actual currency received and then mark the invoices paid. Behind the scenes, the program could create the appropriate entries so that the operation moves quickly.

Get Expert NetSuite Help

Since NetSuite is a platform designed to be adapted to fit specific business requirements, its capacity to be streamlined makes it a joy to work with when encountering unique business challenges. My hope is that this article helps you see how to take care of your foreign currency cash receipt endeavors. Should you have specific NetSuite based requirements for accounting innovations, let’s have a conversation.