This article is relevant if you need to learn and watch a demo for how you can express a NetSuite transaction in another foreign currency.

Background

Working with one of our clients that is a specialist in international payroll, foreign currency is a fundamental topic of concern for their business model. We helped our client re-implement NetSuite after a previous firm produced an unworkable solution that involved exchange rates on line items so they could be repriced at different rates.

The breakthrough came when we thought more fundamentally about the business model:

- Employees in foreign countries expect regular salaries expressed in their currency.

- Payroll companies located in those foreign countries can be engaged to help pay those foreign employees in their local currencies.

- The foreign payroll companies will demand foreign currencies to pay those employees.

- Some of the foreign payroll companies expect a different foreign currency than the one that will be used to pay the employee.

Thus, our client will not pay the foreign employee directly but will instead pay a foreign vendor for services to pay the employee. Fundamentally, we have a business-to-business foreign currency transaction yet with more complexity.

To help understand better the challenge in the model, consider that our client is based in the United States and thus its books are based in USD. They have a customer who has a foreign employee that is in Hungary and wants to be paid in Hungarian Forint. A foreign payroll company will be used to assist. Yet, the foreign payroll company wants to instead be paid Euros to take care of the Hungarian payroll requirements.

On top of all of this, our client offers its customers the ability to pay USD to pay the payroll for the Hungarian foreign employee. Yet, sometimes, our clients have customers who want to pay in yet another currency, such as Canadian Dollars.

This is not simple — yet it can be solved when you understand key methods to drive NetSuite foreign currency.

Foreign Currency Cross Over Opportunities

While we have solved for all the complexities in our client’s situation, this article will focus on one of two different transaction models that are important to consider when working with foreign currency. The most important consideration is that we leverage the account clearing pattern to help us jump foreign currency boundaries. The pattern can be used in many different ways. I have written previous articles on the subject that you may want to consider:

- Solve NetSuite Foreign Currency Cash Operations with the Prolecto Account Clearing Transaction Bundle

- How To Cross NetSuite Foreign Currency Boundaries with the Account Clearing Model

- How To: Multiple Foreign Currency Cash Receipt Settlement

- NetSuite Best Practice: Receive Local Currency for Foreign Currency Invoices

- Learn How To Accept Different Foreign Currency in NetSuite Cash Receipt Operations

- Best Practice: How to Pay a NetSuite Vendor Bill with Foreign Currency

- How To: Transfer Foreign Currency Between NetSuite Subsidiaries

In this particular article, I will discuss and demonstrate a model where you take a current financial obligation, such as a vendor bill or a customer invoice, and express it in yet a different currency when you know up front your target amounts.

The two models relate to timing:

- Up Front: we know immediately at the time we enter the transaction that we want to cross a currency boundary and thus we need to be in that target currency so we can take advantage of NetSuite’s built-in foreign currency gain/loss features due to timing differences.

- Learned Late: when another currency to be priced can be used to satisfy an obligation at some future date, the model is different because we don’t know the price until that time. For example, we pay some of our staff in Bitcoin but we denominate in dollars. We can close the books monthly, like normal, and we always understand our economic obligation. But when it is time to pay, we can take the Bitcoin spot rate and use it to satisfy the dollar obligation at that time.

In this discussion, we will jump the currency boundary up front because we can anchor in the other currency at the time we enter the transaction.

The Up Front NetSuite Foreign Currency Transaction Model

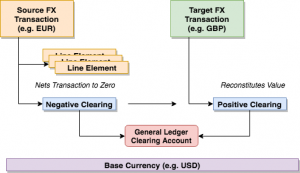

To help understand this model, we leverage account clearing concepts using a NetSuite item that points to a general ledger account that is meant to always be valued at zero. The basic model looks like this:

- Source Transaction: Determine the source transaction’s base currency economic value. Create a negative line on the source transaction to effectively “pay” or net it to zero. At this point, the clearing account will not equal zero.

- Target Transaction: Create another transaction in the desired target currency. Create a single positive line for the target transaction but now express it in a manner that ensures that the transaction’s base economic value is the same as the source. This may require either modifying the exchange rate or the number of foreign currency units depending on the need of the transaction. At this point, the clearing account will return back to zero.

These transactions can be cross-referenced a number of ways so you know they are related.

Demonstration: A NetSuite Tool to Facilitate Crossing Over Transaction Currency Boundaries (4:24)

In the video below (4:24), we demonstrate how we have built a tool to facilitate this process to make it easy to cross the NetSuite up-front foreign currency transaction boundaries.

Get the Prolecto Foreign Currency Transaction Converter

We have developed the tool as demonstrated in the video as a bundle to give to our clients so we can help them solve this upfront foreign currency boundary work. The tool is a framework that can be exploited against invoices and vendor bills as well as others. Like all the algorithms we have created for our clients, we do not charge for the software. Instead, we ensure our clients succeed through our leadership by offering professional implementation and support services. If you have a challenging NetSuite foreign currency consideration, let’s have a conversation.