This article is relevant if you are recording cash payments in NetSuite but are not using NetSuite to drive your accounting.

Background

In my typical client situations, they use NetSuite to drive their accounting operations. This means they use NetSuite to lead their revenue and disbursement operations — and thus there is a natural flow to book both liabilities and assets transactions according to the accrual method of accounting. The cash dimension concludes the transaction cycle — it does not lead.

However, I sometimes see situations where NetSuite is not leading. Other systems and related practices are in place — and NetSuite is used to follow by booking transactions after the fact. In a recent inquiry, an individual came to our firm and asked the following:

“Our bank is not linked with NetSuite. We do not pay from the NetSuite, we pay from the bank and I create transactions to mirror image the real bank transactions.

We paid [a] few pounds more than the bill on one occasion. How can I create the transaction showing I paid a bill and paid extra? And another time we paid ‘on account’ and that was more than the bill we received later. Then the vendor sent us a refund. How should I post/create the two transactions?”

Using NetSuite to Record Vendor Overpayments and Refunds

When you use NetSuite to lead the cash and financial operation, there is no chance to overpay a bill. Vendor Bills are paid via Vendor Payment records which drive cash disbursements. Those disbursement records are effectively bank checks and should be used to record what monies are actually distributed. Vendor Payment transactions are the sum of the underlying amounts applied to the vendor bills — you can not claim to pay more.

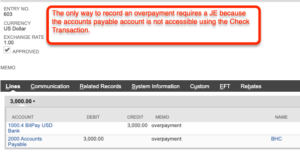

To record a payment to a vendor would generally mean using a Check transaction. However, assuming we are using Accounts Payable to record our Vendor Bills, we would then need our Check transaction to debit the accounts payable account. Yet, NetSuite prevents recording that transaction directly against accounts payable — NetSuite expects check transactions to bypass accounts payable and directly debit the expense account — a reasonable assumption.

As such, we are forced to use journal entries (or, if we were going to do this all the time, we may create custom NetSuite transactions) and record our debits and credits directly against both cash and the accounts payable account.

See the related image for how to book such a transaction. It’s important to record the accounts payable debit against the vendor’s name.

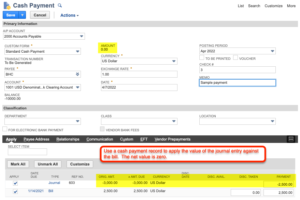

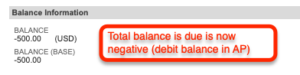

Keeping The Accounts Payable Aging Clear

Once you start working transactions with journal entries in this manner, vendor bills are not connected to their respective journal entry payments; they float. Yet, journal entries based on accounts payable debits can be used to be applied to vendor bills through payment transaction interfaces. Likewise, a vendor returning funds for an overpayment works similarly. To record a refund, use a journal entry to debit cash and credit accounts payable. Then apply these “floating” accounts payable transactions to vendor bills (and possibly vendor credits) so that the accounts payable aging nets to zero.

See related images.

NetSuite Philosophies on Accounting Management

NetSuite is flexible enough to allow the use of journal entries to participate in vendor payment transactions. In my assessment, NetSuite was built with the assumption that the organization is using the platform to lead its accounting operations. Thus, we would not have a chance to overpay cash transactions.

However, for organizations that do indeed pay in advance as a practice, which is common when creating prepaid expenses, we always have the vendor prepayment transaction. In my 2019 article, Understand and Contrast NetSuite Vendor Prepayment Options, I offer thinking on how to powerfully use these transactions.

This individual’s concern too could use vendor prepayments as an alternative to the journal entry in the above example — but we need more information about the actual vendor bills and bookkeeping treatment for actual expenses to make a good assessment of which way to act.

If you found this article relevant, feel free to sign up for notifications to new articles as I post them. If you would like assistance in your NetSuite-driven accounting operation, let’s have a conversation.