This article is relevant if you are looking to create NetSuite cash basis reporting, especially to meet United States 1099 IRS tax reporting.

Background

I have written on NetSuite 1099 reporting challenges in the past. NetSuite dropped support for generating 1099 directly from within the platform in that last couple of years. NetSuite, as well as some NetSuite partners, Yearli, Sovos, and Track 1099 offer bundles that supply a saved search that makes it easier to export NetSuite data and provide it to their platform to generate and distribute 1099 information. In 2015, I also created a 1099 search tool to help overcome some of the limitations, at that time, to NetSuite 1099 reporting.

Yet, all of these offerings likely do not produce correct information. While some may argue, “close enough for government work”, the fundamental challenge is that NetSuite is accrual-based and the Internal Revenue Service wants information summarized based on the cash basis. I spoke in-depth about this challenge in my article, Understand NetSuite 1099 Challenges with SuiteAnalytics Workbook Inspections. This challenge is just as relevant today as the day I wrote the article.

As such, I decided enough was enough and I solved the challenge.

Addendum

While this article still produces the right outcomes, with the advent of NetSuite SuiteQL, another approach was used that streamlined the effort. Please refer to my 2024 article, True NetSuite 1099 Reporting using SuiteQL Engine.

Generating NetSuite Cash Basis General Ledger Entries

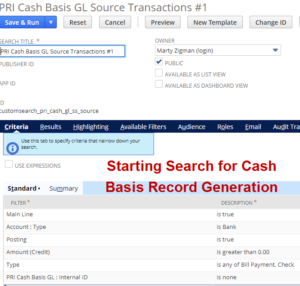

Since NetSuite search and reporting tools are not strong enough to take accrual accounting entries and effectively reclass them into a cash basis presentation, we can instead manufacture entries via custom records that then make it easy to analyze and report on.

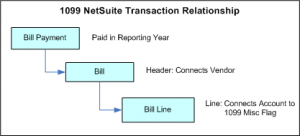

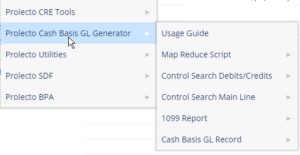

The key to solving this is to respect that the story begins with the cash general ledger accounts (type bank). Thus, all bank account transactions that have a credit basis are subject to inspection for 1099 reporting. Our journey then requires that we assess how credit-based (cash outbound) transactions were applied so that we can find the 1099 GL basis. Hence, I created a NetSuite application that allows for the definition of three searches:

- Source Cash Basis Transactions: find all cash related transactions that need a cash basis story.

- Linked Transactions: find all the transactions that were used to apply the cash; respect that cash can be applied at varying amounts to more than one linked transaction.

- Transaction GL / 1099 Basis: with all the linked transactions discover their respective general ledger account and 1099 miscellaneous basis. Yet, we need to take the weighted average of the underlying line values and apply the amount discovered in the previous search.

With the three searches, I worked with our team to create a NetSuite Map / Reduce script that will then use these three saved search definitions to carefully craft a custom Cash Basis GL reporting entry. While this custom record entry will not have any real financial basis, it will be crafted to work the fundamental requirement for debits to equal credits. We can then inspect each cash transaction and observe its Cash Basis GL impact for reasonableness.

Crafting 1099 Summary Search on Cash Basis Entries

Once we have our cash basis GL entries and we assess they are reasonable, we can now easily create a summary 1099 search that accurately tells the story based on Cash. With this summary search, we then can easily export the information to one of the third parties that generate and distribute 1099 forms and government reporting. See image for a sample of the output.

Framework for Cash Basis Reporting

While I solved for 1099 reporting, I designed the framework to easily support other Cash Basis reporting. The credits on the cash (bank) transactions tell the story of cash disbursements. But the debits on the cash transactions tell the story of revenue. Respecting that our clients may have different rules for how they want their cash basis reporting to work, we are in complete control over the algorithm so that it can be shaped as needed. The framework thus is a template that can be used to accelerate a NetSuite Cash Basis reporting effort.

Solve your 1099 and Other NetSuite Cash Basis Requirements

I am pleased to finally close a chapter in cash-based reporting that has troubled me since 2008, when we first started to work with NetSuite. If you found this article valuable, feel free to sign up for notifications of new articles. If you want to get control over your 1099 or other NetSuite cash reporting, let’s have a conversation.

Per this article, FYI, any cash basis payments made via credit cards, debit cards, PayPal are to be excluded from the 1099 totals because the payment processor will already report those amounts on a 1099-K:

https://quickbooks.intuit.com/learn-support/en-us/1099-misc-payroll-forms/vendor-payments-to-exclude-on-form-1099-misc/00/185835

Thank you Nick for the reference article. I hold that this is one of the considerations: company and regulatory policies need to shape the supply of information — even more of a use case of the approach I have suggesting.

Marty